Contact Our Experts

Reach out to our knowledgeable team to discuss your life insurance needs and receive personalized assistance.

Contact Us

I Consent to Receive SMS Notifications and Alerts from Labrador & Lullo Life, LLC. Message frequency varies. Message & data rates may apply. Text HELP to (312) 684-6548 for assistance. You can reply STOP to unsubscribe at any time.

I Consent to Receive Occasional Marketing SMS Communication from Labrador & Lullo Life, LLC.

Call or Text:

(312) 684-6548

Email Us At:

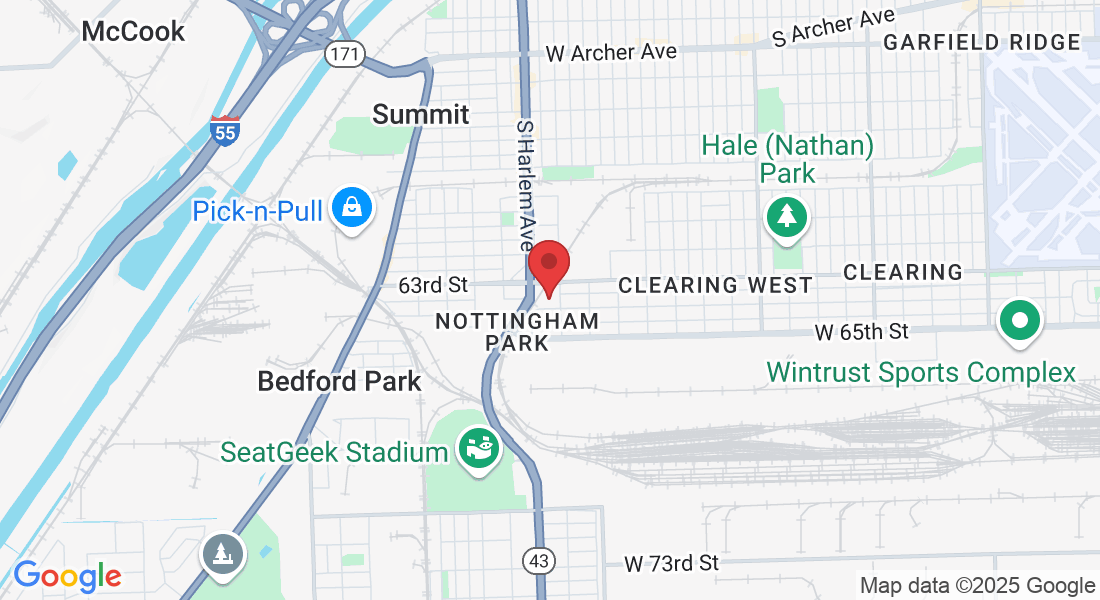

Our Location:

7123 W 63rd Place, Chicago IL 60638

Frequently Asked Questions

Common Questions Answered for your convenience.

How much does final expense insurance typically cost?

Premiums vary depending on your age, health, and the amount of coverage you choose, but final expense policies are generally affordable and come in fixed monthly payment options.

Do I need a medical exam to qualify?

Most final expense insurance policies are no-exam or simplified issue, meaning you only need to answer basic health questions. No lab work or doctor visits are required.

How much coverage can I get?

Coverage amounts typically range from $2,000 to $50,000, depending on the insurer and your personal needs.

How quickly are benefits paid to my beneficiaries?

Once the necessary paperwork is submitted, benefits are often paid within a few days—helping your family cover immediate expenses without delays.

Can my premiums increase over time?

No, most final expense policies offer fixed premiums, meaning your monthly payment will never go up as you age or if your health changes.

Can I get coverage if I have health issues?

Yes, many final expense plans are available to individuals with pre-existing conditions. Guaranteed issue policies are even available with no health questions asked, though they may have a waiting period.